Reimagining how capital flows, rebuilding trust between entrepreneurs and capital providers.

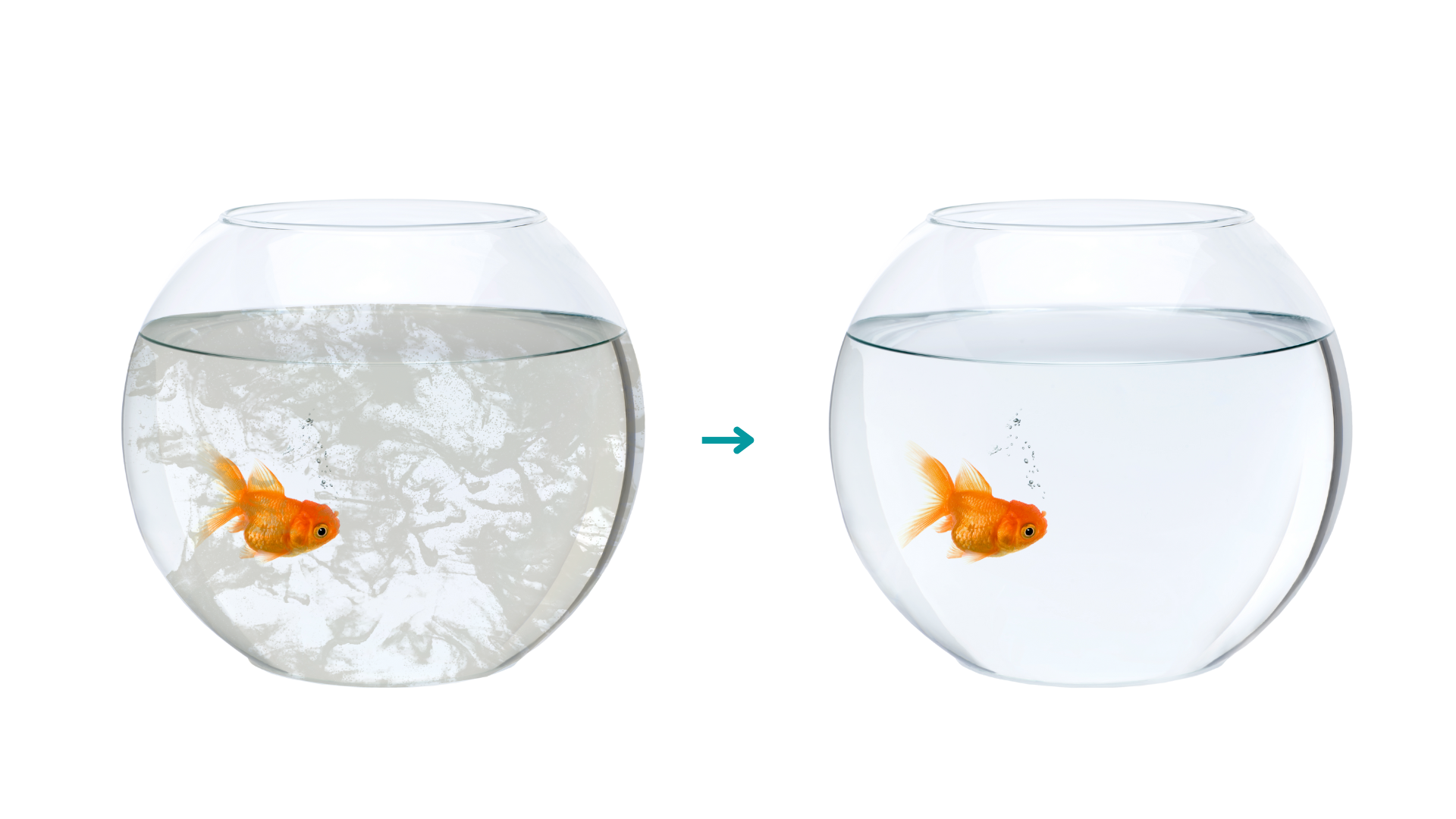

DON’T BLAME THE FISH, CHANGE THE WATER

Underwriting Reimagined

Entrepreneurs, especially people of color, women, and business owners in historically underinvested areas, continue to face real barriers in accessing capital. Underwriting Reimagined was created to meet that call. It is rooted in the belief that the system is most often the barrier—not the entrepreneurs navigating it. Just like the saying, “the fish aren’t sick, it’s the water that needs cleaning,” small businesses aren’t failing because they’re flawed — they’re navigating a financial ecosystem built on outdated, inequitable standards.

Why Now?

For too long, bank underwriting models have reflected historical and contemporary discrimination, creating wealth disparities that disadvantage people of color. Long before the COVID-19 pandemic and its devastating impact on minority-owned businesses, these inequitable systems made it harder for entrepreneurs of color to access credit for homes, businesses, and other essential assets. Today, these outdated models continue to widen the gap in wealth and ownership. If we want a stronger, fairer economy, we cannot adhere to the status quo. We must uncover biases, challenge assumptions, and adopt innovative approaches that both rectify inequities and prudently assess true risk.

Our Goals

We are working with community leaders, underwriters, regulators, innovators, and entrepreneurs to build a better system. Together, our goals are to:

Shift the narrative — Build broad awareness of the systemic reasons for inequality through data and lived experience.

Equip lenders and regulators — Introduce a city-wide SMB Equity Underwriting Toolkit to guide equitable policies and strategies.

Expand access to capital — Increase credit access for Black, Latino, and low-income entrepreneurs through program expansion, new program design, and changes to laws, policies, and guidelines.

The Vision

A financial system where entrepreneurs aren’t punished by inequitable standards — but supported with the tools, policies, and resources they need to thrive.

What We Heard:

Emerging Insights

Capital feels invisible and inaccessible.

The issue isn’t supply, but transparency, relevance, and trust.

Fear and mistrust are rational responses.

Past negative experiences with financial systems fuel hesitation — and self-protection.

Creditworthiness needs a new definition.

Rigid credit scores overlook real indicators like cash flow consistency or community reputation.

Entrepreneurs and capital providers want relationships, not transactions.

Trust, coaching, and flexibility matter as much as capital.

Entrepreneurs’ Perspectives

“I can't find lenders who serve businesses like mine locally.”

“I'm scared of taking on debt that could risk my personal financial stability.”

“Lenders don't seem to understand my seasonal cash flow and industry-specific needs.”

Finance Leaders’ Perspective

Programs do exist, but awareness is limited. Stronger partnerships and outreach are needed.

With proper coaching and preparation, entrepreneurs can build confidence to manage debt responsibly.

We want to offer flexibility, but need stronger risk protections like loan guarantees or reserves.

What’s Next

The next chapter of Underwriting Reimagined is about action:

Launching a storytelling campaign to elevate entrepreneur experiences.

Piloting practical, inclusive lending strategies.

Building communities of practice for collaboration and accountability.

Steering Committee

Erika Hersh, Lift Fund (CDFI)

TC Alexander, Bank of Texas

Keisha Allen, Truist Bank

Heather Lepeska, City of Dallas

Felicia Pearson, Community Reinvestment Fund

Tarsha Hearnes, Consultant

Angel Deleon, Texas Bank

Rosie Rueda, Texas Mezzanine Fund

Marisol Ashford, Comerica Bank

Leighton Watts, JP Morgan Chase

Susie Linebaugh, JP Morgan Chase

Project Leads

Benjamin Vann, Impact Ventures

Todd Adams, Impact Ventures

Erin Kilmore-Neel, Beneficial State Bank

Harold Hogue, CoSpero Consulting

Project Partners

JP Morgan Chase

Beneficial State Foundation

Cospero Consulting

UNT Dallas

Think Three Media